Your client may have Medicare Advantage or Medicare Supplement insurance, but as we’ve stated before, primary health insurance plans only cover so much.

Is there value to selling cancer, heart attack and stroke plans? Why would (or should!) anyone buy an insurance policy that’s so specific? Let’s take a deeper look at the benefits and payouts.

Many People Have Cancer or a Heart Attack or Stroke

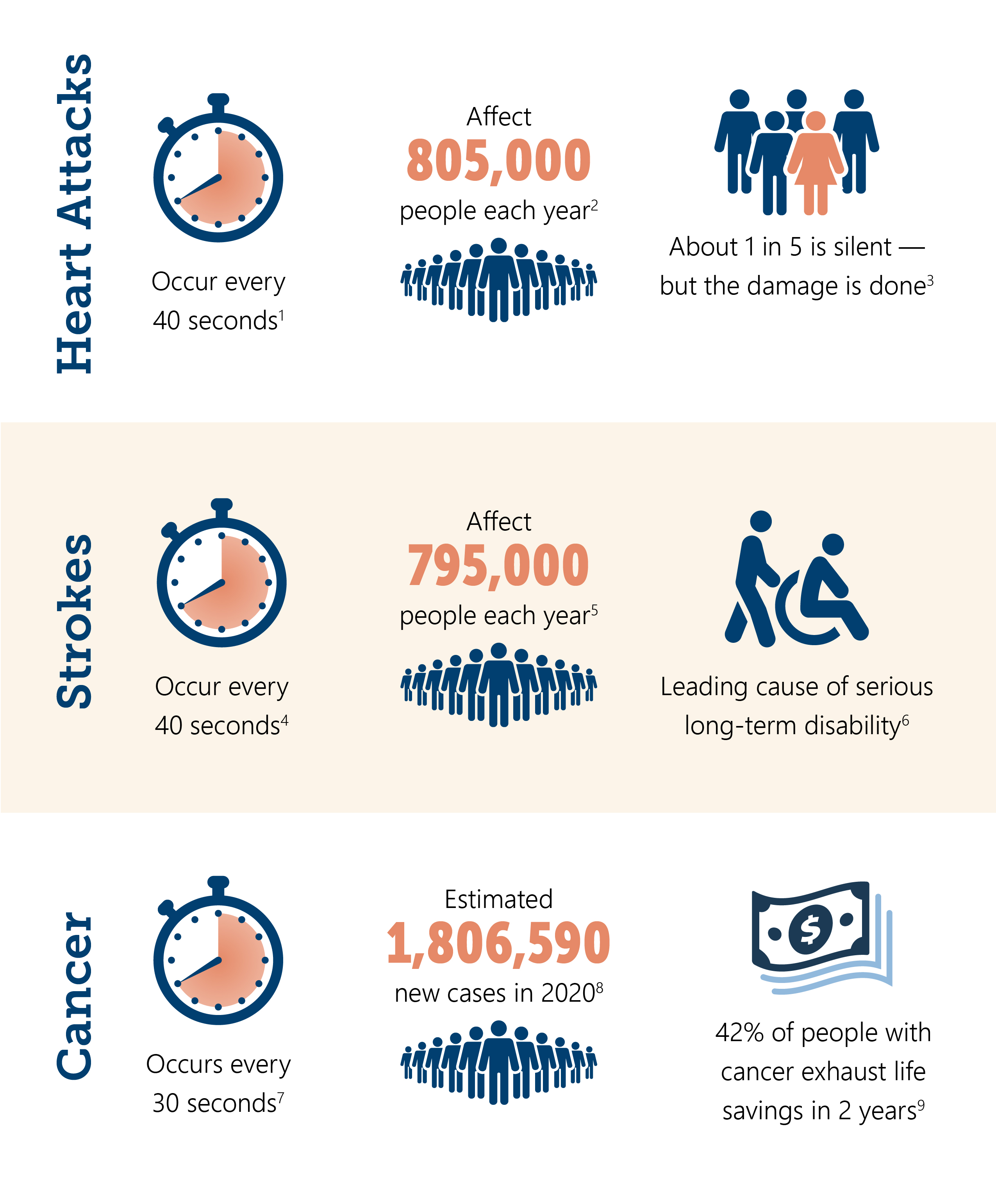

These conditions are not rare. In fact, heart disease, cancer, and stroke all make the top five in the Centers for Disease Control and Prevention’s list of the leading causes of death in the United States. We’d go as far to say that you probably personally know multiple people who have had a heart attack, stroke, or cancer.

The American Heart Association estimates that approximately 805,000 heart attacks occur and about 795,000 individuals have a stroke every year.

In regard to cancer, about 40 percent of men and women will be diagnosed with it during their life, according to the National Cancer Institute.

A Growing Number of People Are Surviving These Conditions

While cardiovascular disease, cancer, and stroke are among the leading causes of death in U.S., these conditions are not as deadly as they once were. Nowadays, more than 90 percent of people survive a heart attack, and about 70 percent of people survive cancer five years or more after being diagnosed. This is great news, right?

People are surviving these types of illnesses, but the financial impact can last months or years beyond the health event.

While surviving is the first step, it doesn’t come free of charge. Life after a diagnosis of heart attack, stroke, or cancer can be stressful as doctor, hospital, and pharmaceutical bills begin to stack up.

People are surviving these types of illnesses, but the financial impact can last months or years beyond the health event. Health insurance agents must ensure their clients are aware of the coverage gaps and ways to fill them.

What This Secondary Protection Covers That Primary Medical Plans Don’t

One common objection to selling cancer insurance and heart attack and stroke insurance we hear is that a client’s medical insurance should largely cover their medical costs.

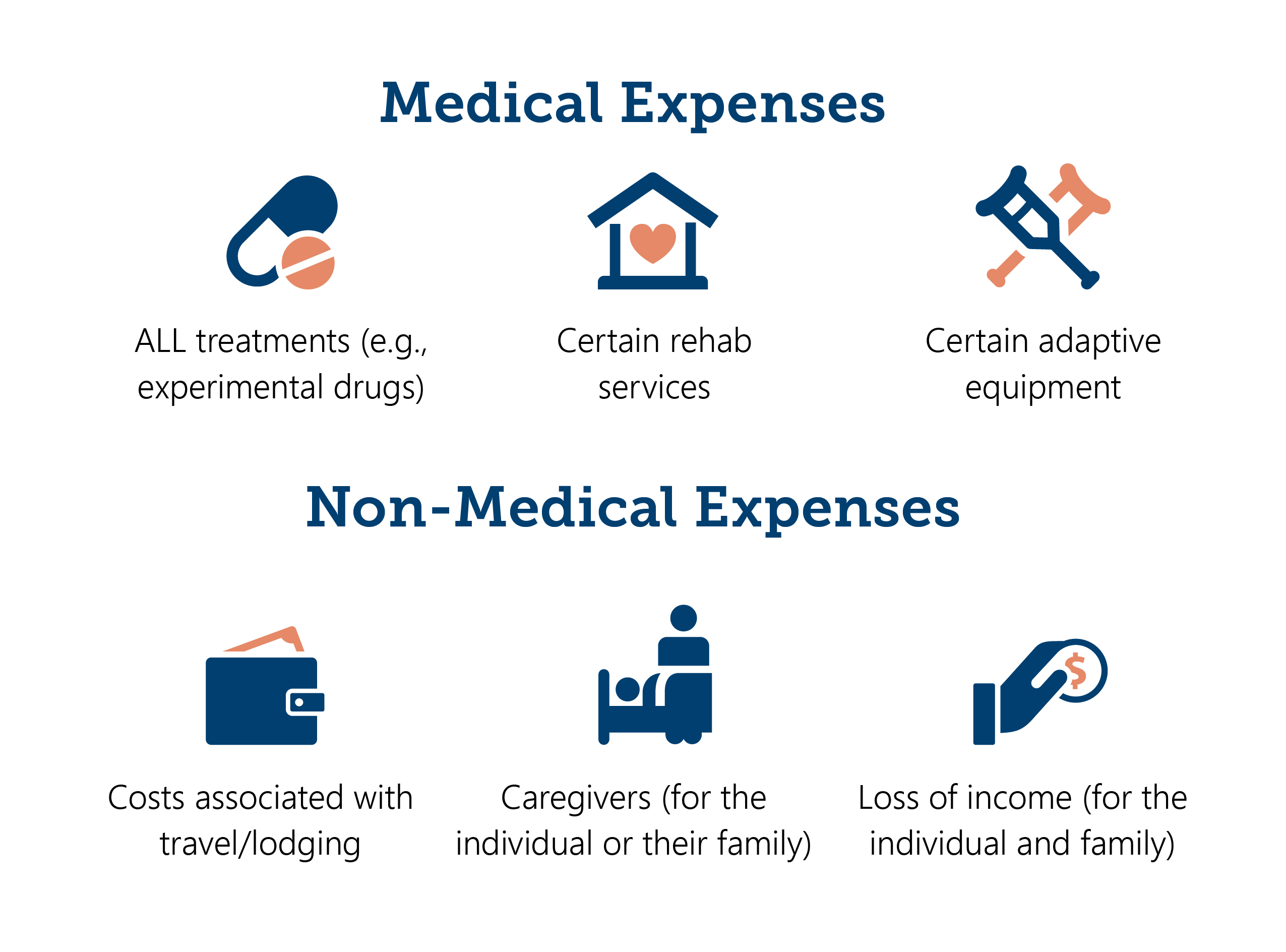

While this may be true, especially for those who have a Medicare Supplement plan, it will not cover all of a client’s drugs and treatments. And, it certainly won’t cover all the non-medical, indirect costs associated with these conditions.

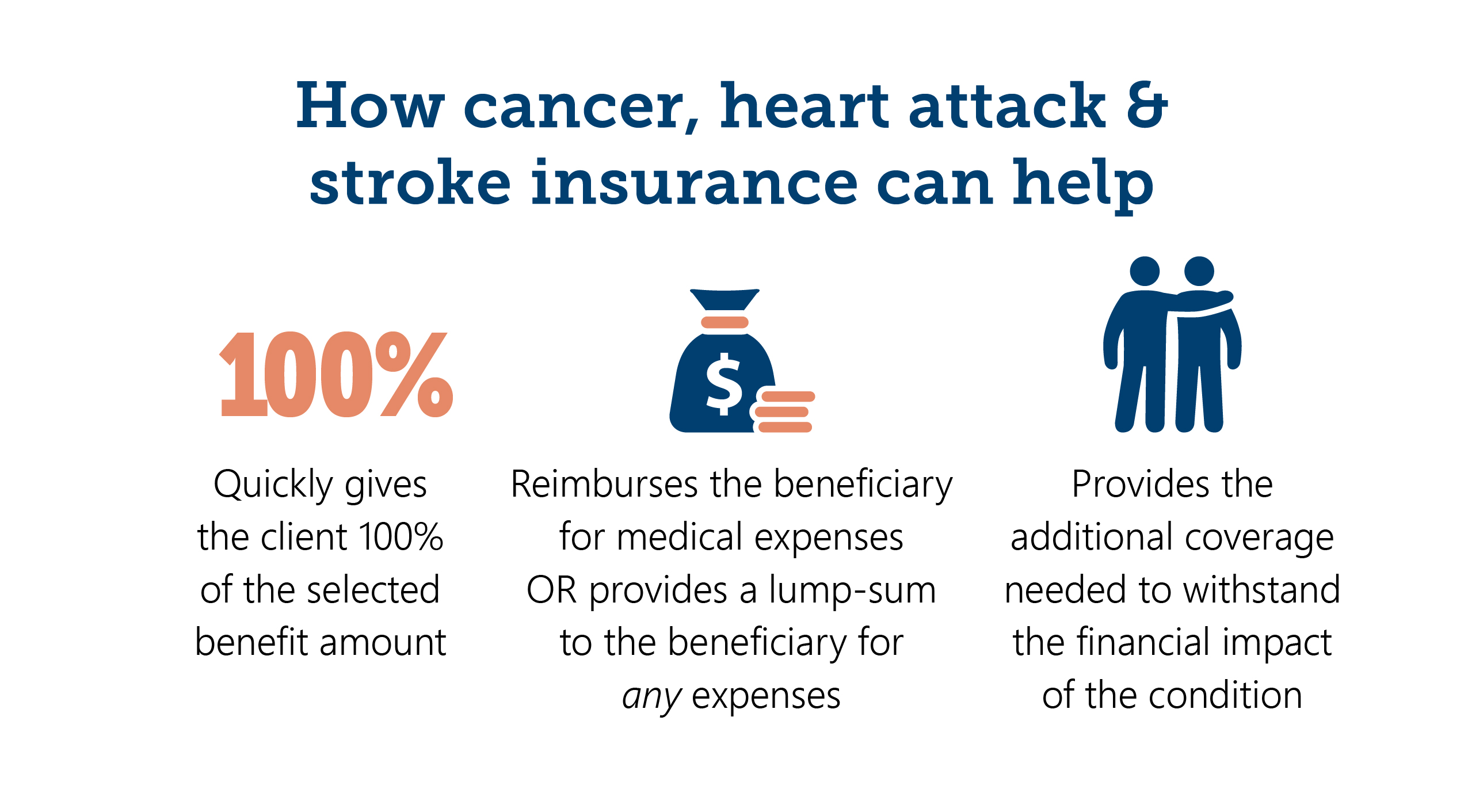

Insurers design cancer and heart attack and stroke plans to:

1. Directly reimburse beneficiaries for certain medical expenses not covered by primary health plans;

2. Provide lump-sum payouts that beneficiaries can use toward any costs they wish (medical or non-medical). Carriers pay these benefits regardless of other health insurance coverage.

Let’s say one of your clients is diagnosed with a critical illness, specifically cancer, and does not have a cancer, heart attack or stroke policy. If he or she wants to try experimental treatments, they may have to pay for them out-of-pocket.

If your client decides to travel out of state to get the best medical care available, he or she will likely have to pay for their transportation and any lodging and meals.

Later, they may also have to pay out of pocket for certain rehab services, caregivers, and adaptive equipment they may need to maintain a certain quality of life.

And, if the individual needs to take an extended leave of absence from work to get treatment, their family may also have to go down to one income — none if their spouse or partner also takes off work to offer support.

Here are the out-of-pocket expenses so far to help you keep track:

The American Heart Association reports that the average annual direct and indirect costs of cardiovascular disease and stroke in the U.S. totaled about $417.9 billion between 2020 and 2021.

At minimum, these conditions can cost your clients a few thousand dollars to treat, and that’s on top of all their other usual monthly bills.

Offering your clients a second insurance plan, that kicks in after one of these common major health events, can provide them and their families with more financial relief, and peace of mind, than their primary health plans alone can deliver.

At minimum, these conditions can cost your clients a few thousand dollars to treat, and that’s on top of all their other usual monthly bills.

But Why Sell Cancer, Heart Attack and Stroke Plans vs. Critical Illness Insurance?

Critical illness plans also offer coverage for these conditions. What’s better: critical illness insurance or combination cancer, heart attack and stroke plans?

The Disadvantage of Critical Illness Plans

Critical illness insurance offer similar benefits for qualifying cancer, heart attack or stroke cases, as well as other illnesses; however, that extra coverage comes at a higher price. Simply put, not everyone can afford to pay that higher price.

What’s more, critical illness plans are not always an option for seniors. Most carriers will only issue critical illness insurance up to age 64. In some cases, a person may qualify for this type of coverage up to age 70, but this is rare.

Critical illness plans are not always an option for seniors.

The Advantage of Cancer, Heart Attack and Stroke Insurance

A combination of cancer insurance and heart attack and stroke coverage can still give them some protection, against the most common conditions Americans face, at less cost than a critical illness plan.

Cancer, heart attack and stroke plans are a secondary form of coverage that can fill in the gaps left by other policies and quickly give your clients 100 percent of the selected benefit amount, providing them the additional support needed to withstand the financial impact of a tough diagnosis.

It only takes a second to go from thinking you’re healthy to facing a critical illness like cancer or a heart attack or stroke. By offering your clients a “second” piece of coverage, you can help them be more financially prepared for whatever their futures hold.

1,2,4,5,6Virani, Salim S., et al. “Heart Disease and Stroke Statistics — 2021 Update: A Report From the American Heart Association.” Circulation, 2021.

3Virani, Salim S., et al. “Heart Disease and Stroke Statistics — 2020 Update: A Report From the American Heart Association.” Circulation, vol. 141, no. 9, 2020, pp. 139–596.

7”CANCER FACTS & THE WAR ON CANCER.” SEER Training Modules, National Cancer Institute. Accessed 9 Jan. 2021.

8”Cancer of Any Site - Cancer Stat Facts.” SEER. Accessed 3 Feb. 2026.

9Haefner, Morgan. “Cancer forces 42% of patients to exhaust life savings in 2 years, study finds.” Becker’s Hospital CFO Report, Becker’s Hospital Review, 2018.

Not affiliated with or endorsed by Medicare or any government agency.

Share Post